Living with significant debt can feel like carrying a heavy weight that affects every decision you make. Whether it is student loans, credit card balances, or personal lines of credit, the stress of monthly payments can be overwhelming. However, achieving financial freedom is not impossible; it requires a strategic approach, discipline, and the right plan. This guide outlines complete debt reduction plans that work, providing you with the tools necessary to dismantle your debt systematically.

Step 1: The Financial Assessment

Before you can conquer your debt, you must face it head-on. Many people avoid looking at their statements because of anxiety, but clarity is the first step toward resolution. create a comprehensive list of every single debt you owe. This list should include the name of the creditor, the total balance, the interest rate (APR), and the minimum monthly payment. Having this data organized in a spreadsheet or a notebook will allow you to choose the most effective strategy for your specific situation.

Step 2: Establishing a Zero-Based Budget

No debt reduction plan can succeed without a solid budget foundation. A zero-based budget ensures that every dollar you earn has a specific job, whether it is covering necessities, savings, or debt repayment. By tracking your income and expenses meticulously, you can identify areas where money is leaking—such as unused subscriptions or excessive dining out—and redirect those funds toward your debt.

The Debt Snowball Method: Psychological Momentum

One of the most popular techniques for debt reduction is the Debt Snowball Method. This strategy focuses on behavioral modification rather than pure mathematics. To implement this plan, you list your debts from the smallest balance to the largest balance, regardless of the interest rate. You pay minimum payments on everything except the smallest debt, which you attack with every extra dollar available.

The power of the Snowball method lies in the quick wins. When you pay off that first small debt, you gain a sense of accomplishment and motivation. You then roll the money you were paying on the first debt into the payment for the second smallest debt, creating a ‘snowball’ effect. This method is highly effective for individuals who need immediate positive reinforcement to stay committed to the process.

The Debt Avalanche Method: Mathematical Efficiency

If you are motivated by saving the most money on interest, the Debt Avalanche Method is likely the superior choice. In this plan, you list your debts from the highest interest rate to the lowest. You pay minimums on all accounts but funnel your excess cash toward the debt with the highest APR. Once that high-interest debt is gone, you move to the next highest.

Mathematically, the Avalanche method is the most efficient route because it minimizes the amount of compound interest you pay over the life of your loans. While it may take longer to see the first debt completely disappear compared to the Snowball method, the long-term savings can be substantial, potentially shaving months or years off your total repayment timeline.

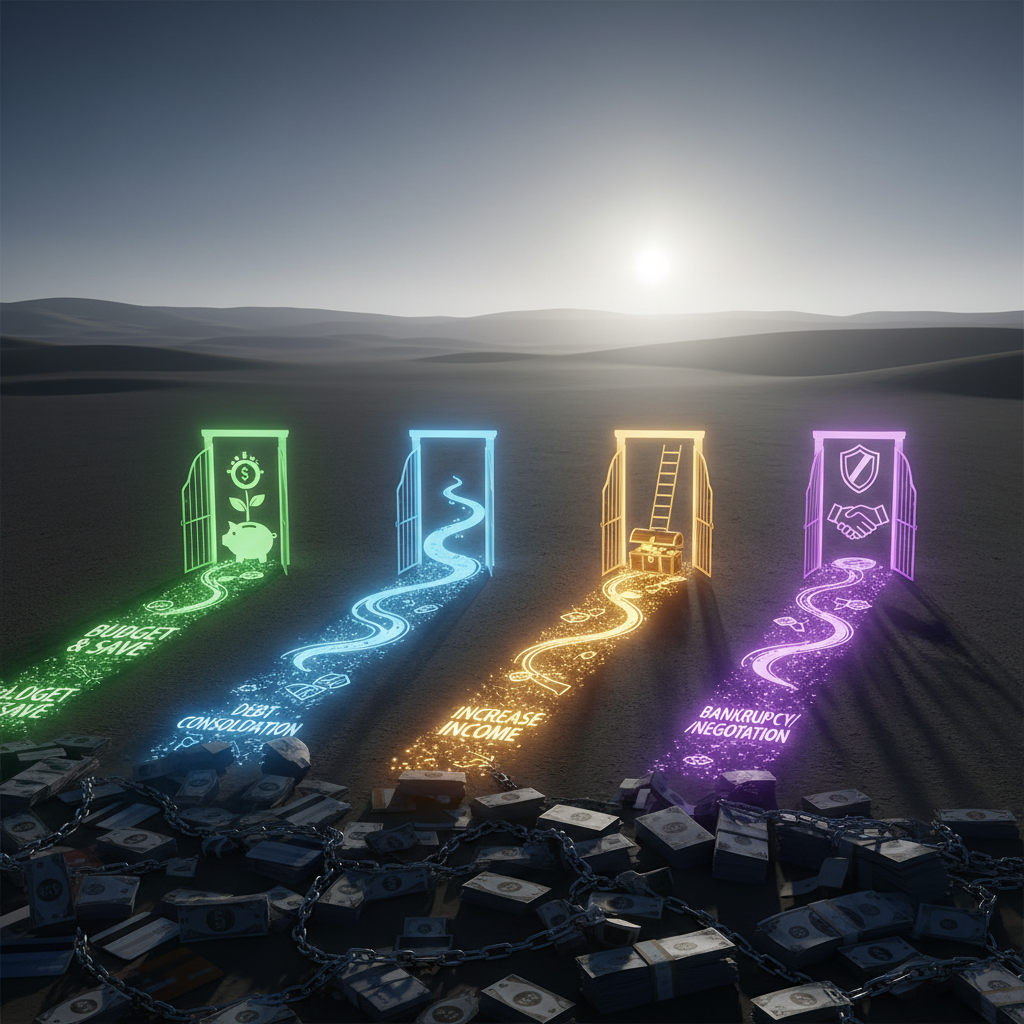

Debt Consolidation Strategies

For those juggling multiple payments with varying due dates and high interest rates, debt consolidation can simplify the process. This involves taking out a new loan to pay off multiple smaller debts, leaving you with a single monthly payment. Ideally, the new loan should have a significantly lower interest rate than the average of your previous debts.

- Personal Loans: Unsecured loans from banks or credit unions used to pay off credit cards.

- Balance Transfer Cards: transferring high-interest credit card debt to a card offering a 0% introductory APR period (usually 12-18 months).

- Home Equity Loans: Using the equity in your home to secure a lower rate, though this carries the risk of foreclosure if you default.

Negotiating with Creditors

Many consumers are unaware that credit terms are often negotiable. If you have a history of on-time payments but are struggling with the current load, call your creditors. You can request a lower interest rate or a temporary hardship plan. A reduced APR means more of your monthly payment goes toward the principal balance rather than interest, accelerating your debt reduction plan.

The Snowflake Method: Micro-Payments

The Snowflake Method is a supplementary technique that works alongside the Snowball or Avalanche methods. It involves using small, unexpected amounts of money to pay down debt immediately. Did you save $5 using a coupon? Send it to the credit card. Did you get a $20 birthday gift? Apply it to the loan. These micro-payments may seem insignificant individually, but they accumulate rapidly and reduce the principal balance, lowering the interest charged in the following cycle.

Increasing Your Income: The Shovel Ratio

While cutting expenses is crucial, there is a limit to how much you can trim from your budget. Conversely, there is no limit to how much you can earn. Increasing your income—often referred to as getting a bigger shovel—is a vital component of aggressive debt reduction. This could involve picking up a side hustle, freelancing, selling unused items, or asking for overtime at your current job. Every extra dollar earned should be dedicated strictly to debt repayment.

Building an Emergency Fund

It may seem counterintuitive to save money while you are in debt, but a small emergency fund is essential. Without a buffer of $1,000 to $2,000, a single unexpected expense like a car repair or medical bill will force you back into using credit cards, breaking your momentum. Think of this fund as an insurance policy for your debt reduction plan.

Lifestyle Changes and Sacrifice

Successful debt reduction often requires temporary lifestyle changes. This might mean cancelling vacations, driving an older car, or cooking at home exclusively. It is important to remember that these sacrifices are not permanent. You are living like no one else now so that later you can live and give like no one else. Visualizing your debt-free life can help sustain your motivation during these leaner months.

Seeking Professional Help

If your debt is overwhelming and self-directed plans are not working, consider non-profit credit counseling. Agencies can help you set up a Debt Management Plan (DMP). Under a DMP, you make one monthly payment to the agency, which then distributes funds to your creditors. These agencies often have pre-arranged agreements with card issuers to lower interest rates and waive fees, helping you become debt-free in 3 to 5 years.

Conclusion: Staying the Course

Eliminating debt is a marathon, not a sprint. There will be months where progress feels slow, but consistency is the key to success. By choosing the right strategy—whether it is the Snowball, Avalanche, or Consolidation—and pairing it with a strict budget and increased income, you can dismantle your debt. Start today, stick to the plan, and reclaim your financial future.