Living under the shadow of debt can be an emotionally and financially draining experience that affects every aspect of your life. However, achieving a debt-free status is not an impossible dream; it requires a strategic approach, discipline, and a fundamental shift in how you manage your finances. To escape debt permanently, one must look beyond quick fixes and commit to a long-term overhaul of financial habits and priorities.

Conducting a Thorough Debt Audit

The first step in any successful debt escape plan is to face the reality of your situation. You must conduct a comprehensive financial audit by listing every single debt you owe, including credit cards, personal loans, student loans, and medical bills. For each entry, note the total balance, the minimum monthly payment, and the annual percentage rate (APR). This clarity is essential for prioritizing which debts to tackle first.

Once you have a complete list, categorize your debts based on their interest rates. High-interest debt, such as credit card balances, should be your primary concern because it grows the fastest. Seeing the total amount in black and white can be overwhelming, but it is the necessary foundation for building a roadmap toward total financial independence.

Implementing the Debt Snowball Method

The Debt Snowball method is a psychologically driven strategy where you pay off your smallest debts first while making minimum payments on the larger ones. When the smallest debt is gone, you take the money you were paying toward it and apply it to the next smallest debt. This creates a sense of momentum and accomplishment, which is crucial for staying motivated over a long period.

Utilizing the Debt Avalanche Strategy

For those who prefer a more mathematically efficient approach, the Debt Avalanche method is highly effective. Instead of focusing on the balance size, you prioritize the debt with the highest interest rate. By eliminating high-interest debt first, you reduce the total amount of interest paid over time, potentially saving thousands of dollars and shortening your repayment period significantly.

Creating and Sticking to a Zero-Based Budget

You cannot effectively pay off debt without a clear understanding of your cash flow. A zero-based budget involves assigning every dollar of your income a specific purpose before the month begins. This ensures that you are not mindlessly spending money that could otherwise be directed toward your debt repayment goals. It requires tracking every expense, no matter how small.

To make your budget work, you must distinguish between needs and wants. During your debt-clearing phase, it is often necessary to temporarily eliminate luxury expenses such as subscription services, frequent dining out, or expensive hobbies. Redirecting these funds into your debt payments will accelerate your progress and bring you closer to freedom.

Negotiating with Creditors for Lower Rates

Many debtors do not realize that they have the power to negotiate. Contacting your creditors to request a lower interest rate can be surprisingly effective, especially if you have a history of making payments on time. A lower APR means more of your monthly payment goes toward the principal balance rather than interest, speeding up the process of becoming debt-free.

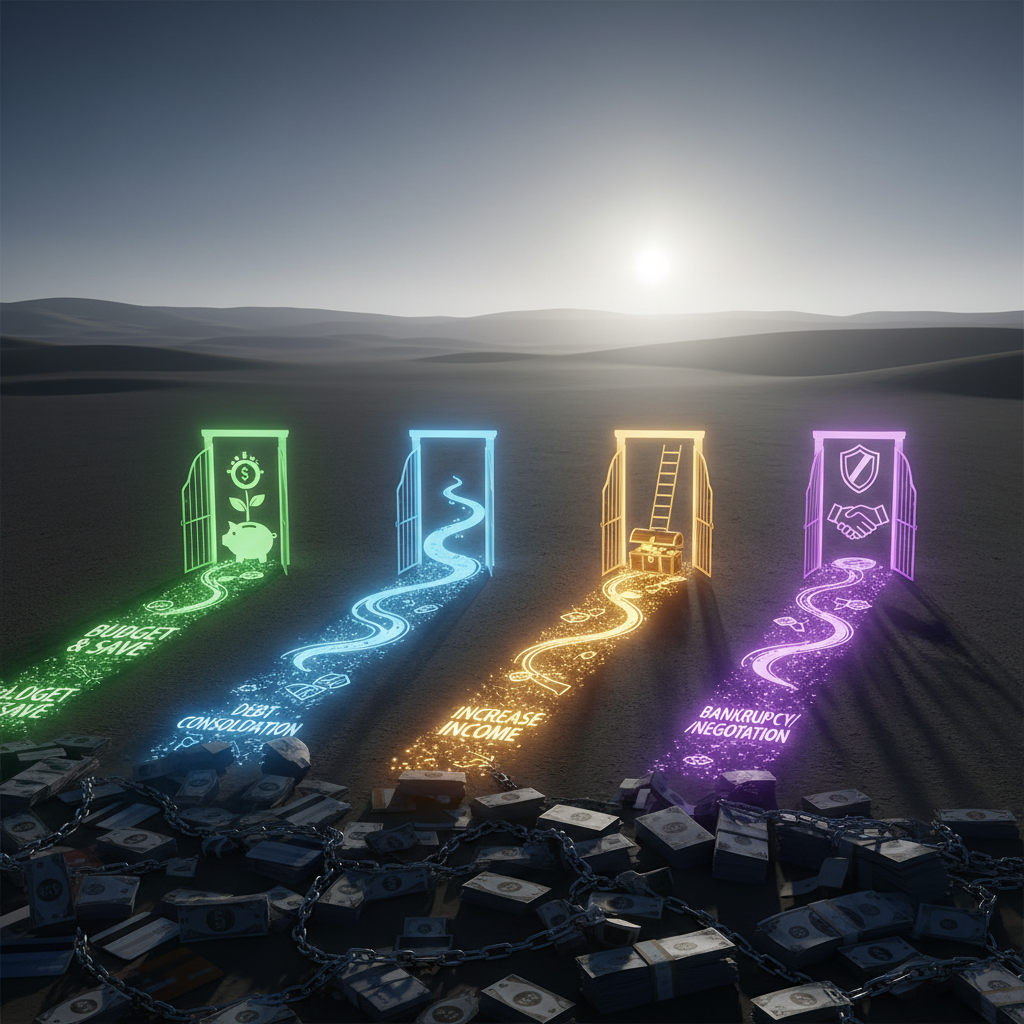

The Role of Debt Consolidation

Debt consolidation involves taking out a new loan with a lower interest rate to pay off multiple high-interest debts. This simplifies your finances by leaving you with only one monthly payment. However, consolidation is only a solution if you address the spending habits that led to the debt in the first place; otherwise, you risk running up new balances on your cleared cards.

Increasing Your Income for Faster Payoff

While cutting expenses is vital, there is a limit to how much you can save. Conversely, there is theoretically no limit to how much you can earn. Consider starting a side hustle, taking on overtime at work, or selling unused household items. Every extra dollar earned should be funneled directly into your debt repayment plan to drastically reduce the timeframe.

Building an Initial Emergency Fund

It may seem counterintuitive to save money while you are in debt, but having a small emergency fund (typically $1,000 to $2,000) is essential. This safety net prevents you from reaching for a credit card when an unexpected car repair or medical bill arises, ensuring that a minor crisis does not derail your entire debt-free journey.

Changing Your Psychological Relationship with Money

Permanent debt escape requires a fundamental shift in mindset. You must move away from a culture of instant gratification and embrace delayed gratification. Understanding the triggers that lead to emotional spending and replacing them with healthy habits is key to ensuring that once you are out of debt, you stay out of debt forever.

Seeking Professional Credit Counseling

If your debt feels unmanageable, seeking help from a reputable, non-profit credit counseling agency can provide a lifeline. These professionals can help you set up a Debt Management Plan (DMP), where they negotiate with creditors on your behalf for lower rates and consolidated payments, providing a structured path out of financial distress.

Avoiding Predatory Lending Practices

In the quest to pay off debt, it is crucial to avoid quick fix schemes like payday loans or high-fee debt settlement companies. These options often carry exorbitant interest rates and fees that can trap you in a deeper cycle of poverty. Stick to proven, transparent methods that prioritize your long-term financial health over temporary relief.

Monitoring Your Credit Score Progress

As you pay down your balances, your credit utilization ratio will improve, leading to a higher credit score. Monitoring this progress can be a great source of motivation. A better credit score will eventually grant you access to better financial products, lower insurance premiums, and more favorable terms for future necessities like a mortgage.

Establishing a Sustainable Debt-Free Lifestyle

Once the final payment is made, the ultimate goal is to maintain that freedom. This involves continuing to live on a budget, building a full emergency fund of three to six months of expenses, and shifting your focus from debt repayment to wealth building and investing. By following these comprehensive approaches, you can transform your financial future and live a life free from the burden of debt.