Living a life free from the constraints of debt is more than just a financial goal; it is a fundamental shift in how one interacts with money and personal freedom. Essential debt free living explained insights begin with the realization that every dollar owed to a creditor is a dollar of your future labor already spent. By reclaiming these funds, individuals can build a foundation of security that supports long-term prosperity and reduces the chronic stress associated with monthly installments and high interest rates.

The Psychology of Financial Independence

The journey toward becoming debt-free often starts in the mind. Understanding the psychological triggers that lead to overspending is crucial for anyone looking to break the cycle of borrowing. Many people use debt to maintain a lifestyle that exceeds their current income, often driven by social pressure or a desire for instant gratification. Recognizing these patterns allows for a mindset shift where financial peace is valued more than material possessions.

One of the most profound benefits of a debt-free lifestyle is the reduction of anxiety. When you no longer have to worry about how to cover multiple loan payments, your mental bandwidth expands, allowing you to focus on career growth, family, and personal development. This clarity is a cornerstone of essential debt free living explained insights, emphasizing that financial health is inextricably linked to overall well-being.

Establishing a Robust Budgetary Framework

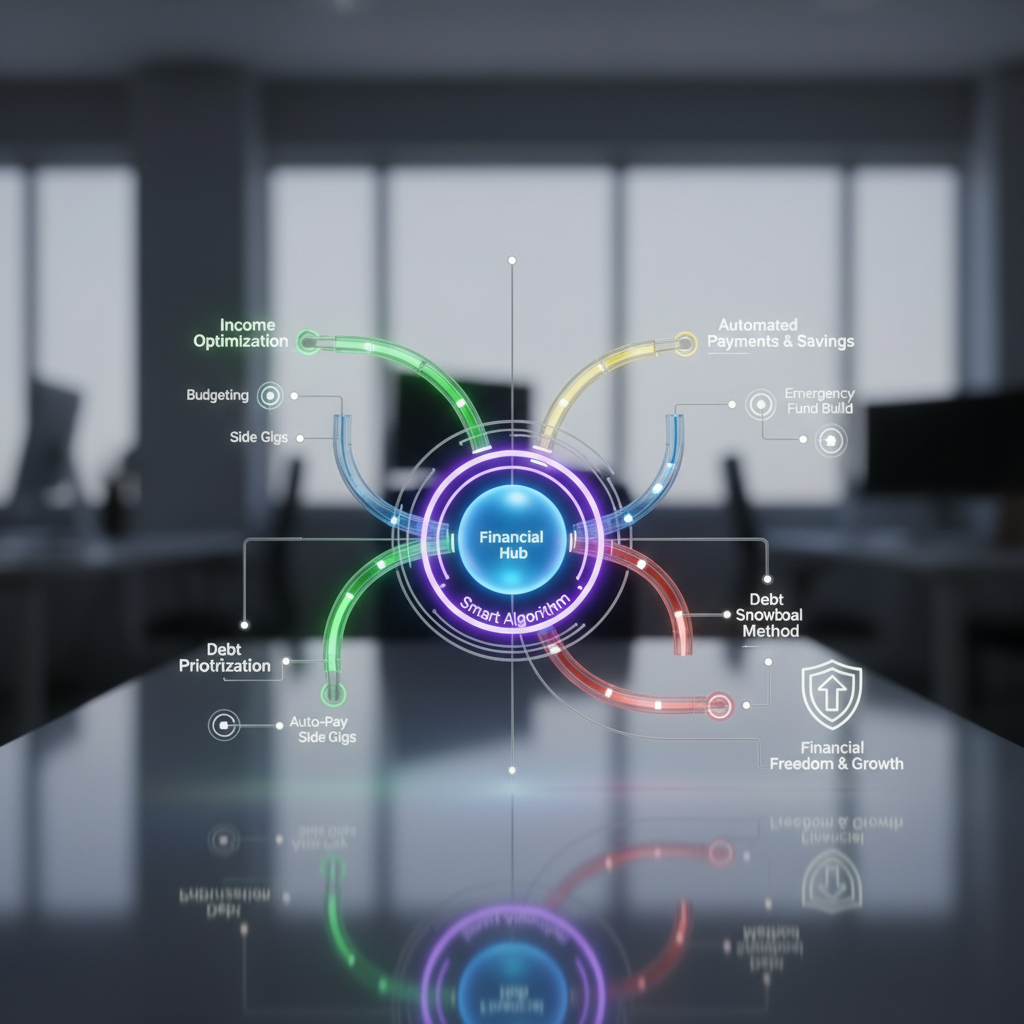

A successful transition to debt-free living requires a meticulous approach to budgeting. This is not about restriction, but rather about giving every unit of currency a specific purpose. By tracking income and expenses with precision, you can identify leakages where money is being wasted on non-essential services or impulsive purchases. A well-structured budget acts as a roadmap, guiding you toward your goal of total financial autonomy.

To build an effective budget, consider the following components:

- Fixed Expenses: Necessary costs like housing, utilities, and insurance.

- Variable Expenses: Costs that fluctuate, such as groceries and transportation.

- Discretionary Spending: Non-essential items like entertainment and dining out.

- Debt Servicing: The minimum payments required for existing liabilities.

Proven Strategies for Debt Repayment

When tackling existing debt, two primary methods stand out: the Debt Snowball and the Debt Avalanche. The Debt Snowball focuses on paying off the smallest balances first to gain psychological momentum. Seeing a debt disappear completely provides a sense of accomplishment that fuels the drive to tackle larger balances. Conversely, the Debt Avalanche prioritizes debts with the highest interest rates, which is mathematically more efficient and saves more money over time.

Choosing between these methods depends on your personal motivation style. If you need quick wins to stay focused, the snowball method is ideal. However, if you are strictly focused on minimizing interest costs, the avalanche method is the superior choice. Regardless of the path chosen, the key is consistency and the commitment to stop adding new debt while paying off the old ones.

The Critical Role of the Emergency Fund

One of the most overlooked essential debt free living explained insights is the necessity of an emergency fund. Without a cash cushion, any unexpected expense—such as a medical bill or car repair—can force you back into the cycle of high-interest borrowing. Financial experts generally recommend saving three to six months of living expenses to ensure that life’s inevitable surprises do not derail your progress toward debt freedom.

Starting small is better than not starting at all. Even a modest fund of one thousand dollars can act as a buffer against minor emergencies, preventing the need to rely on credit cards. As you pay off debt, you can redirect those former payment amounts into your emergency fund, further strengthening your financial defenses.

Adopting a Frugal and Intentional Lifestyle

Frugality is often misunderstood as deprivation, but in the context of debt-free living, it is about intentionality. It means choosing to spend money on things that truly add value to your life while ruthlessly cutting costs on things that do not. This might involve cooking at home more often, opting for used instead of new items, or finding free community activities for entertainment.

By lowering your cost of living, you increase the gap between your income and your expenses. This gap is the engine of wealth creation. The larger the gap, the faster you can pay down debt and the more you can eventually invest. Intentional living ensures that your spending aligns with your long-term values rather than fleeting impulses.

Navigating the Influence of Credit Scores

A common concern when pursuing a debt-free life is the impact on one’s credit score. While it is true that active credit usage is a factor in scoring models, being debt-free does not mean you must have a poor score. Maintaining a single credit card for small, recurring expenses—and paying it off in full every month—can keep your score healthy without incurring interest debt. The goal is to make credit work for you, rather than you working for your creditors.

Investing in Your Future Self

Once the burden of debt is lifted, the focus shifts from the past to the future. The money that used to go toward interest can now be funneled into retirement accounts, education funds, or diversified investment portfolios. This is where true wealth is built. Compounding interest, which once worked against you in the form of debt, now works for you, accelerating your path to financial independence.

Diversification is key to protecting your newly acquired wealth. Consider a mix of assets, such as:

- Low-cost Index Funds: For broad market exposure.

- Real Estate: For tangible asset growth and potential rental income.

- Bonds: For capital preservation and steady returns.

Maintaining a Debt-Free Lifestyle Long-Term

Reaching a debt-free status is a monumental achievement, but maintaining it requires ongoing vigilance. It is easy to slide back into old habits once the pressure of debt is gone. Staying debt-free involves regular financial check-ins, adjusting your budget as life circumstances change, and continuing to educate yourself on personal finance. Surround yourself with a supportive community or mentors who share your values regarding financial stewardship.

In conclusion, essential debt free living explained insights reveal that financial freedom is a journey of discipline, education, and habit formation. By understanding the mechanics of debt, mastering your cash flow, and preparing for the unexpected, you can break free from the shackles of interest and build a life of choice and abundance. The peace of mind that comes with owning your future is worth every sacrifice made along the way.