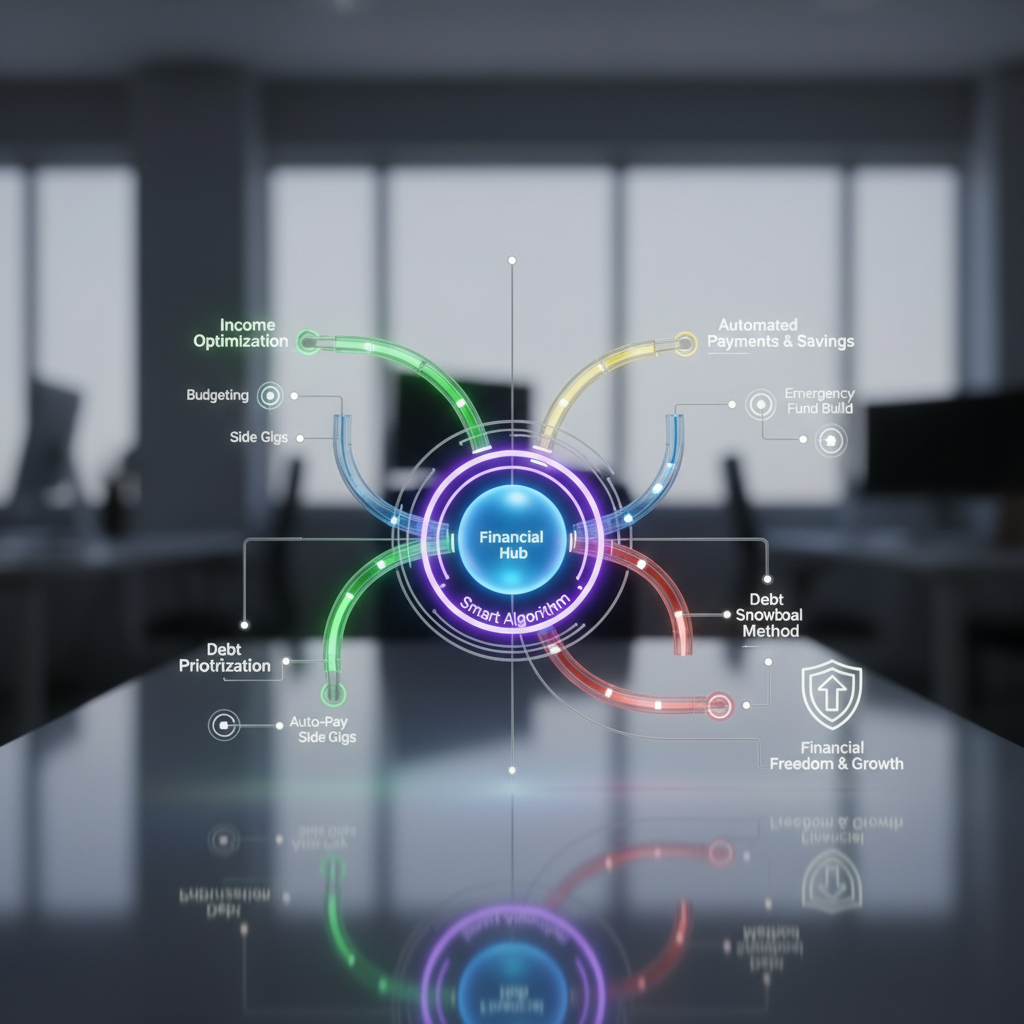

Managing debt effectively requires more than just making monthly payments; it demands a Complete Smart Debt Management Strategies Framework. In an era where credit is easily accessible, many individuals find themselves overwhelmed by multiple liabilities. A structured approach helps in regaining control over personal finances and building a foundation for future wealth. By understanding the nuances of interest rates, repayment terms, and psychological triggers, one can navigate the complex landscape of debt with confidence.

Understanding the Core Pillars of Debt Management

A robust framework for debt management is built upon several key pillars: assessment, prioritization, optimization, and sustainability. Without a clear map of where you stand, it is impossible to determine the best path forward. The Smart Debt Management process begins with a cold, hard look at every penny owed, from credit card balances to student loans and mortgages. This transparency is the first step toward financial liberation.

The initial phase involves creating a comprehensive debt inventory. This list should include the creditor name, total balance, annual percentage rate (APR), minimum monthly payment, and due dates. Seeing these figures in one place can be daunting, but it is necessary for identifying which debts are the most toxic. High-interest consumer debt, for example, often takes precedence due to its compounding nature, which can quickly spiral out of control if left unaddressed.

The Debt Snowball vs. The Debt Avalanche

Two of the most popular strategies within the framework are the Debt Snowball and the Debt Avalanche methods. The Debt Snowball method focuses on psychological wins by paying off the smallest balances first. This creates a sense of momentum as debts disappear one by one. While not the most mathematically efficient, it is highly effective for those who need frequent motivation to stay on track with their repayment plan.

Conversely, the Debt Avalanche method prioritizes debts with the highest interest rates. By targeting the most expensive debt first, you minimize the total interest paid over time and shorten the overall repayment period. This strategy is ideal for disciplined individuals who are focused on the mathematical bottom line. Both methods have their merits, and the choice depends largely on individual temperament and financial goals.

Strategic Debt Consolidation Techniques

Debt consolidation is another vital component of a smart framework. This involves taking out a new loan with a lower interest rate to pay off multiple high-interest debts. Common tools include:

- Balance transfer credit cards with 0% introductory APR.

- Personal consolidation loans from banks or credit unions.

- Home equity lines of credit (HELOC) for those with property assets.

When used correctly, consolidation simplifies the repayment process into a single monthly payment and reduces the financial burden of interest.

However, consolidation is only a tool, not a cure. Without addressing the underlying spending habits that led to the debt, consolidation can lead to a dangerous cycle where the original debts are cleared but the credit lines are quickly refilled. A Smart Debt Framework insists on a strict moratorium on new credit usage during the repayment phase to ensure that the consolidation actually results in a lower total debt load.

Negotiating with Creditors for Better Terms

Many consumers do not realize that debt terms are often negotiable. Creditors would often rather receive a partial payment or a lower interest rate than risk a total default. Negotiating for a lower APR can save hundreds or even thousands of dollars over the life of a loan. It is important to approach these conversations professionally, armed with a clear explanation of your financial situation and a realistic proposal for repayment.

In cases of extreme hardship, debt settlement or hardship programs may be available. These programs can temporarily lower payments or even forgive a portion of the principal balance. While these options can negatively impact your credit score in the short term, they are often preferable to bankruptcy. Understanding the trade-offs is a critical part of the Smart Debt Management decision-making process.

Integrating Budgeting into the Framework

A debt management plan is only as strong as the budget that supports it. Implementing a zero-based budget ensures that every dollar earned has a specific purpose, whether it is for essential living expenses or debt reduction. By identifying leaks in your spending—such as unused subscriptions or excessive dining out—you can redirect those funds toward your debt goals. Consistency in budgeting is the engine that drives the entire framework forward.

The Role of an Emergency Fund

It may seem counterintuitive to save money while you are in debt, but establishing a starter emergency fund is essential. This small buffer, typically one month of expenses, prevents you from reaching for a credit card when an unexpected car repair or medical bill arises. By breaking the reliance on new debt to cover emergencies, you create a safety net that protects your progress and provides peace of mind.

Optimizing Interest Rates and Refinancing

For long-term debts like mortgages or student loans, refinancing can be a powerful strategy within the framework. When market interest rates drop, or your credit score improves significantly, refinancing allows you to replace an old loan with a new one at a lower rate. This can drastically reduce your monthly obligations and the total cost of borrowing, freeing up more cash flow to tackle other high-interest liabilities.

Monitoring and Maintaining Credit Health

As you work through the framework, monitoring your credit score is vital. Paying down debt reduces your credit utilization ratio, which is a major factor in your credit score. A higher score opens doors to better financial products and lower interest rates in the future. Using credit monitoring tools helps you track your progress and ensures that there are no errors on your credit report that could hinder your financial recovery.

Psychological Resilience and Debt Fatigue

Debt repayment is often a marathon, not a sprint. Debt fatigue is a real phenomenon where individuals lose motivation after months or years of restricted spending. To combat this, the framework should include small, non-monetary rewards for reaching milestones. Maintaining a positive mindset and focusing on the why behind your financial goals—such as family security or early retirement—is just as important as the numbers on the spreadsheet.

Transitioning to Wealth Accumulation

The ultimate goal of the Complete Smart Debt Management Strategies Framework is to move from a state of negative net worth to positive wealth accumulation. Once high-interest debts are eliminated, the same discipline used to pay off creditors can be redirected toward investing and retirement savings. This transition marks the final stage of the framework, where debt is no longer a burden but a managed tool, and financial independence becomes a reality.