Understanding the Foundation of Financial Success

Achieving financial success is not merely a matter of luck or inheritance; it is the result of disciplined habits, strategic planning, and a deep understanding of core economic principles. To truly master your finances, you must first define what success looks like for you individually. It involves creating a sustainable lifestyle where your income exceeds your expenses, allowing you to build wealth that serves your long-term goals and provides a sense of security.

The first core principle is the cultivation of a wealth mindset. This involves shifting from a scarcity perspective to one of abundance and long-term thinking. Successful individuals view money as a tool for growth rather than just a means for immediate consumption. By focusing on value creation and delayed gratification, you can make decisions that benefit your future self rather than seeking temporary satisfaction through impulsive spending.

Setting Clear and Actionable Financial Goals

Without a roadmap, it is impossible to reach your destination. Setting SMART (Specific, Measurable, Achievable, Relevant, and Time-bound) financial goals is crucial. Whether you aim to buy a home, fund your children’s education, or retire early, having documented objectives keeps you motivated and accountable. These goals act as the North Star for your financial decisions, helping you prioritize where every dollar should be allocated.

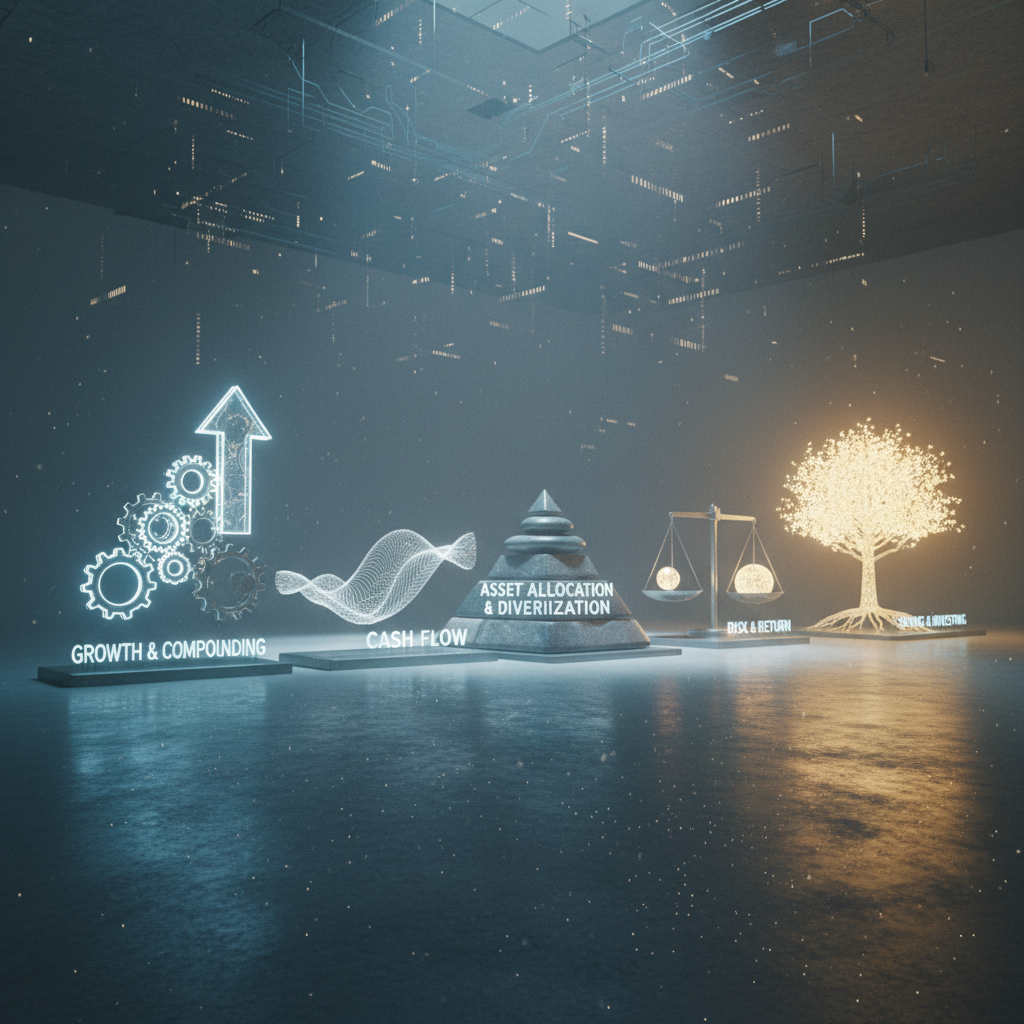

Effective cash flow management is the engine of financial growth. You must have a clear understanding of where your money comes from and, more importantly, where it goes. Utilizing budgeting tools or the 50/30/20 rule—allocating 50% to needs, 30% to wants, and 20% to savings and debt repayment—can provide a structured framework for managing your monthly income effectively.

Distinguishing Between Assets and Liabilities

One of the most profound insights into financial success is the ability to distinguish between assets and liabilities. An asset is something that puts money into your pocket, such as stocks, real estate, or a business. A liability is something that takes money out of your pocket, such as a car loan or high-interest credit card debt. To build wealth, your primary focus should be on acquiring income-producing assets while minimizing non-essential liabilities.

Mastering debt is another non-negotiable principle. While bad debt like consumer loans can erode your net worth, good debt—such as a mortgage or a low-interest business loan—can sometimes be used as leverage to build wealth. The key is to eliminate high-interest debt aggressively and avoid using credit to fund a lifestyle that your current income cannot support.

The Necessity of an Emergency Fund

Life is unpredictable, and financial shocks can derail even the best-laid plans. Establishing an emergency fund that covers three to six months of essential living expenses is a fundamental safety net. This liquidity ensures that you do not have to liquidate long-term investments or take on high-interest debt when faced with medical emergencies, job loss, or urgent home repairs.

The power of compound interest is often referred to as the eighth wonder of the world. By reinvesting your earnings, you generate returns on your previous returns. The earlier you start investing, the more time your money has to grow exponentially. Even small, consistent contributions to a retirement account or brokerage fund can grow into a substantial nest egg over several decades due to the compounding effect.

Strategic Investment and Diversification

Diversification is the primary tool for managing investment risk. Spreading your capital across different asset classes—such as equities, bonds, real estate, and commodities—protects you from the volatility of any single market. A well-diversified portfolio ensures that a downturn in one sector does not result in the total loss of your capital, providing a more stable path toward long-term growth.

Continuous financial literacy is a lifelong journey. The economic landscape is constantly evolving, with new tax laws, investment vehicles, and market trends emerging regularly. Dedicating time to read financial literature, attend seminars, or consult with professionals keeps you informed and capable of making sophisticated decisions that protect and enhance your wealth.

Optimizing for Tax Efficiency

It is not just about how much you earn, but how much you keep. Understanding tax-advantaged accounts, such as 401(k)s, IRAs, or health savings accounts (HSAs), can significantly impact your net returns. By legally minimizing your tax liability through strategic planning and deductions, you retain more capital to reinvest into your wealth-building engine.

Protecting your assets through comprehensive insurance is a core principle often overlooked. Health, life, disability, and property insurance safeguard you against catastrophic financial losses. Without proper coverage, a single unfortunate event could wipe out years of accumulated savings and investments, making risk management a cornerstone of a robust financial plan.

The Role of Automation in Wealth Building

Human psychology often works against financial discipline. Automation removes the friction of decision-making by automatically transferring funds to savings and investment accounts on payday. By “paying yourself first” through automated systems, you ensure that your financial goals are prioritized before any discretionary spending occurs, leading to consistent and effortless wealth accumulation.

Developing multiple income streams provides financial resilience and accelerates the path to independence. Relying solely on a single paycheck is risky. Successful individuals often diversify their income through side businesses, dividend-paying stocks, rental properties, or royalties. These additional streams provide a buffer during economic downturns and increase the total capital available for reinvestment.

Maintaining a Long-Term Perspective

Financial success is a marathon, not a sprint. It requires patience and the emotional discipline to stay the course during market fluctuations. Avoid the temptation of “get-rich-quick” schemes or trying to time the market. A steadfast commitment to your core principles, combined with the passage of time, is the most reliable strategy for achieving significant and lasting prosperity.

Summary of Core Insights

- Mindset: Focus on long-term growth and value.

- Planning: Set SMART goals and maintain a strict budget.

- Investing: Leverage compound interest and diversify your portfolio.

- Protection: Build emergency funds and secure adequate insurance.

- Consistency: Automate your finances and keep learning.

By integrating these core principles into your daily life, you create a powerful foundation for financial freedom. Success is the result of small, intelligent choices made consistently over time.