Living with significant debt can feel like carrying a heavy weight that never lightens. It affects not only your bank account but also your mental health, relationships, and future opportunities. Understanding why you should adopt debt reduction plans that work is the first step toward reclaiming your financial freedom. Without a structured strategy, payments often cover only the interest, leaving the principal balance untouched and prolonging the cycle of indebtedness for years or even decades.

The importance of a solid debt reduction plan cannot be overstated. It provides a roadmap out of financial chaos, transforming a vague desire to be debt-free into actionable steps. When you implement a proven system, you move from reactive payments—paying bills as they arrive—to a proactive approach where every dollar has a specific purpose. This shift in mindset is crucial for long-term success and is often the difference between those who stay in debt and those who achieve financial independence.

The Psychology Behind Effective Debt Reduction

One of the primary reasons you need a specific plan is the psychological component of money management. Debt is frequently a result of behavioral habits rather than just a lack of income. Effective plans address these behaviors by offering quick wins or logical progressions that keep you motivated. When you see balances decreasing, the dopamine release encourages you to stick to the plan, creating a positive feedback loop that replaces the stress of owing money with the satisfaction of paying it off.

The Debt Snowball Method: Momentum Over Math

The Debt Snowball method is one of the most popular strategies advocated by financial experts. This approach focuses on behavioral modification rather than pure mathematics. You list your debts from the smallest balance to the largest balance, regardless of the interest rate. You pay minimum payments on everything else but throw every extra dollar at the smallest debt.

- Step 1: List debts from smallest to largest balance.

- Step 2: Pay minimums on all debts except the smallest.

- Step 3: Pay as much as possible on the smallest debt until it is gone.

- Step 4: Roll the amount you were paying on the first debt into the payment for the next smallest debt.

The reason the Snowball method works so well is that it provides immediate psychological victories. Knocking out a small credit card balance or a medical bill in a few months gives you proof that you can succeed. This momentum builds like a snowball rolling down a hill, eventually becoming a powerful force capable of wiping out much larger debts like car loans or student loans.

The Debt Avalanche Method: Mathematical Efficiency

If you are motivated more by numbers and efficiency than by psychological wins, the Debt Avalanche method might be superior for you. In this strategy, you list your debts from the highest interest rate to the lowest. By targeting the debt with the highest interest rate first, you minimize the total amount of interest paid over the life of your loans, which mathematically allows you to get out of debt faster.

While the Avalanche method saves the most money, it can be harder to stick with if your highest-interest debt also has a large balance. It might take a long time to see that first account close, which can be discouraging for some. However, for those with the discipline to persist without immediate gratification, this is the most cost-effective route to debt freedom.

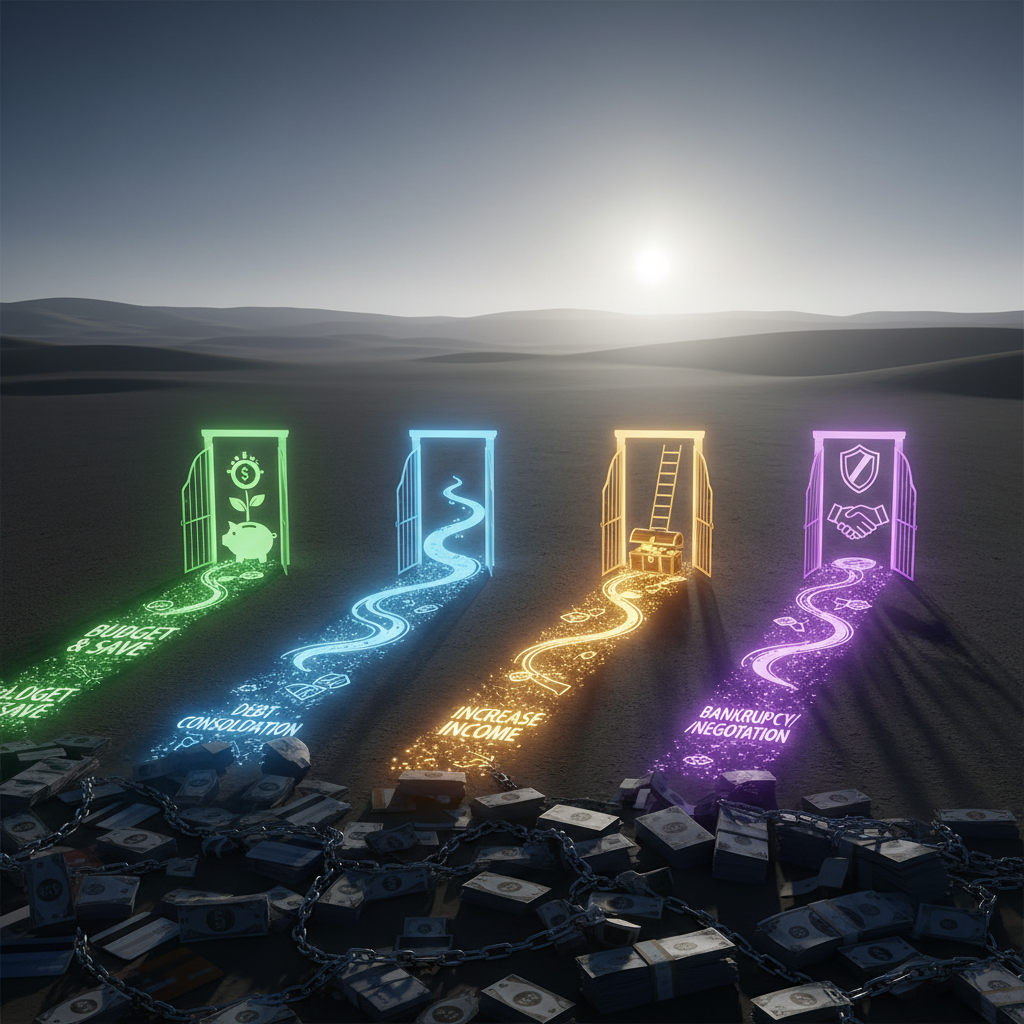

Debt Consolidation: Simplifying the Chaos

Another avenue to consider is debt consolidation. This involves taking out a new loan to pay off multiple existing debts. Ideally, the new loan has a lower interest rate than your current debts, and it simplifies your life by combining multiple monthly payments into a single bill. This can reduce the mental load of tracking various due dates and minimum amounts.

Warning: Debt consolidation only works if you address the root cause of the debt. If you consolidate your credit cards into a personal loan but continue to overspend on those zero-balance cards, you will end up with twice the debt. It is a tool for organization and interest reduction, not a magic cure for spending habits.

The Role of a Zero-Based Budget

No debt reduction plan can succeed without a robust budget. A zero-based budget requires you to assign every dollar of your income a job before the month begins. This ensures that you are not just hoping to have money left over for debt repayment, but that you are prioritizing it. By cutting unnecessary subscriptions, dining out, and luxury items, you free up cash flow that accelerates your chosen debt payoff strategy.

Negotiating with Creditors

Many people do not realize that debt terms can sometimes be negotiated. If you are struggling, contacting your creditors to request a lower interest rate or a hardship plan can be beneficial. A lower interest rate means more of your monthly payment goes toward the principal balance. While not every creditor will agree, the potential savings make the phone call worth the effort.

Building an Emergency Fund to Stop the Cycle

It may seem counterintuitive to save money while you are in debt, but establishing a small emergency fund is a critical component of a debt reduction plan. Without a buffer of $1,000 or one month’s expenses, a single unexpected event—like a car repair or medical emergency—will force you to use credit cards again. An emergency fund acts as a safety net, ensuring that life’s surprises don’t derail your progress.

Lifestyle Changes and Increasing Income

Sometimes, cutting expenses isn’t enough; you need to increase the size of your shovel. Taking on a side hustle, selling unused items around the house, or working overtime can drastically shorten your debt-free timeline. When you combine increased income with a strict budget and a method like the Snowball or Avalanche, the results can be exponential.

Ultimately, the best debt reduction plan is the one you can stick to. Whether you choose the psychological boost of the Snowball, the mathematical savings of the Avalanche, or the simplicity of consolidation, the key is consistency. By committing to a plan today, you are investing in a future where your income belongs to you, not your creditors.