Understanding the Foundation of Debt Management

Achieving long-term financial success requires a deep understanding of how debt operates within your personal economy. Debt is often categorized into two main types: good debt and bad debt. Good debt typically involves investments that have the potential to increase in value or generate long-term income, such as student loans or mortgages. Conversely, bad debt involves high-interest liabilities used for depreciating assets, such as credit card balances for consumer goods. Distinguishing between these two is the first step in prioritizing which obligations to eliminate first.

Creating a Comprehensive Debt Inventory

Before implementing any repayment strategy, you must have a clear picture of your total financial landscape. This involves creating a detailed list of every outstanding balance, including the creditor name, the total amount owed, the interest rate, and the minimum monthly payment. Having this data in one place allows you to see the true cost of your borrowing and helps in deciding whether to focus on high-interest rates or smaller balances first. Without this inventory, management efforts are often scattered and less effective.

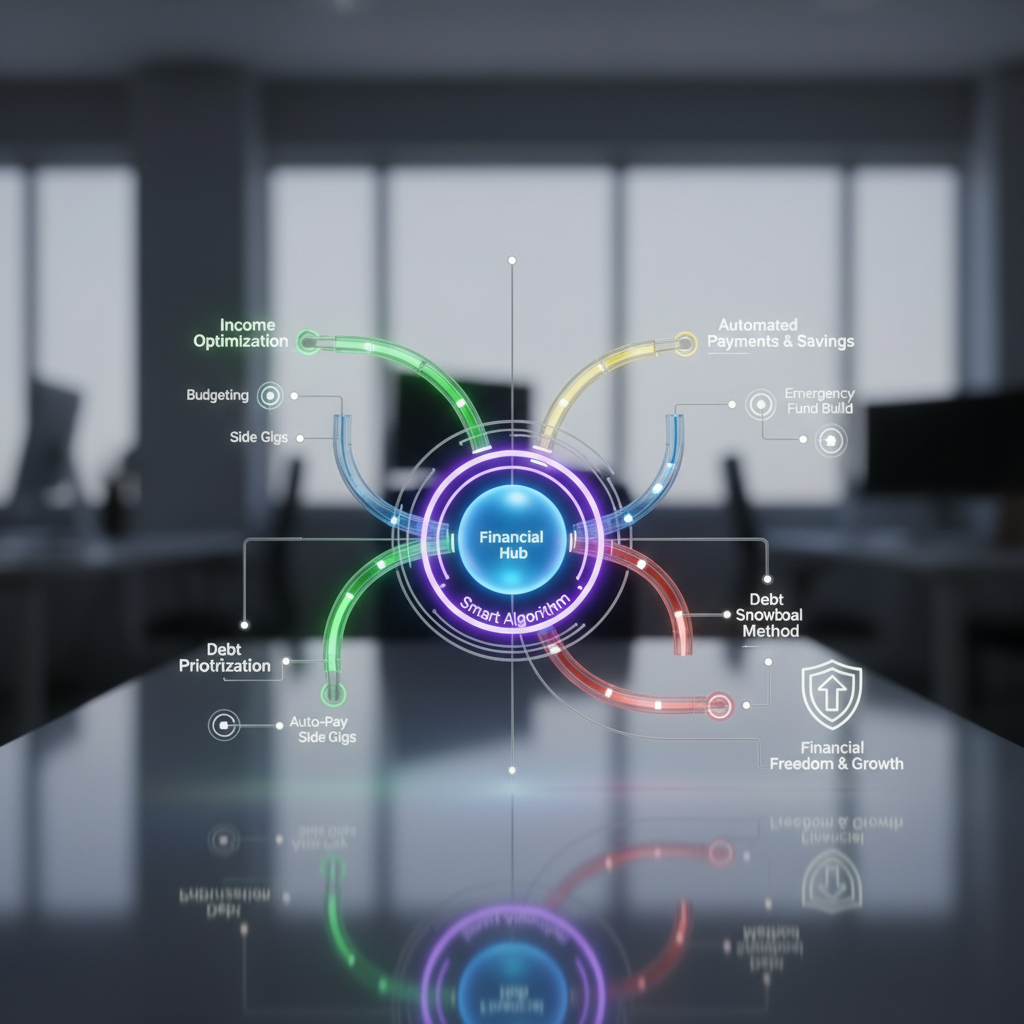

The Debt Snowball Method for Psychological Momentum

The Debt Snowball method is a popular strategy that focuses on the psychological benefits of quick wins. Using this approach, you pay the minimum on all debts except for the smallest balance, toward which you put as much extra cash as possible. Once the smallest debt is paid off, you roll that payment into the next smallest debt. This create a ‘snowball’ effect. Although it may not be the most mathematically efficient method if your largest debts have the highest interest rates, the sense of accomplishment from closing accounts can provide the motivation needed to stay the course.

The Debt Avalanche Method for Mathematical Efficiency

For those focused on minimizing interest costs, the Debt Avalanche method is often the superior choice. This strategy involves ranking debts by their interest rates and prioritizing the one with the highest rate first. By aggressively targeting high-interest debt, such as credit cards with 20% APR or higher, you reduce the total amount of interest paid over time. While it may take longer to see an individual account closed compared to the snowball method, the long-term savings in interest can be substantial, leading to a faster overall path to being debt-free.

Implementing the 50/30/20 Budgeting Rule

Effective debt management is impossible without a structured budget. The 50/30/20 rule is an excellent framework for balancing debt repayment with daily living. Under this rule, 50% of your after-tax income goes to needs (housing, utilities, groceries), 30% to wants, and 20% to savings and debt repayment. If your debt burden is significant, you may choose to temporarily shift a portion of your ‘wants’ budget toward debt to accelerate your progress. Consistency in budgeting ensures that you do not incur new debt while trying to pay off the old.

Exploring Debt Consolidation Options

Debt consolidation involves taking out a new loan to pay off multiple smaller debts, effectively combining them into a single monthly payment. This is particularly beneficial if the new loan has a lower interest rate than the average of your previous debts. Consolidation can simplify your financial life and reduce monthly outlays. Common tools include personal loans or home equity lines of credit. However, it is vital to address the spending habits that led to the debt in the first place, otherwise, you risk running up new balances on the now-empty credit cards.

Utilizing Balance Transfer Credit Cards

For those with high-interest credit card debt but a relatively good credit score, 0% APR balance transfer cards can be a powerful tool. These cards offer an introductory period, often 12 to 21 months, where no interest is charged on transferred balances. This allows every penny of your payment to go directly toward the principal. It is crucial to have a plan to pay off the entire balance before the introductory period ends, as the interest rates typically spike significantly afterward.

Negotiating with Creditors and Lenders

Many consumers do not realize that interest rates and payment terms are often negotiable. If you have a history of on-time payments, you can call your credit card issuers to request a lower interest rate. Furthermore, if you are experiencing financial hardship, many lenders have ‘hardship programs’ that can temporarily lower your payments or pause interest accrual. Being proactive and communicating with your creditors before you miss a payment is a hallmark of smart debt management.

Building an Emergency Fund During Repayment

A common mistake in debt management is putting every spare cent toward debt without building a safety net. This often leads to a cycle where an unexpected expense, such as a car repair or medical bill, forces you to use credit cards again. Most experts recommend building a starter emergency fund of $1,000 to $2,000 before aggressively attacking debt. This small cushion provides a buffer that prevents you from sliding back into debt when life’s surprises occur.

Automating Your Financial Life

Automation is a powerful ally in avoiding late fees and maintaining a stellar credit score. By setting up automatic payments for at least the minimum amount due on all your accounts, you ensure that you never miss a deadline. You can then manually add extra payments to your priority debt. Automation reduces the cognitive load of managing multiple accounts and ensures that your debt reduction plan stays on track even during busy months.

The Role of Lifestyle Inflation and Discipline

As your income grows, it is tempting to increase your spending—a phenomenon known as lifestyle inflation. To manage debt effectively for the long term, you must resist this urge. Instead of upgrading your lifestyle with every raise or bonus, direct those funds toward your debt or your investment accounts. Maintaining a lifestyle below your means is the most reliable way to ensure that debt does not become a recurring problem in your financial future.

Monitoring Your Credit Score and Report

Your credit score is a reflection of your debt management habits and affects your ability to borrow at favorable rates in the future. Regularly monitoring your credit report allows you to track your progress and identify any errors that might be dragging your score down. As you pay down balances, your credit utilization ratio improves, which typically leads to a higher credit score. A better score can eventually lead to refinancing opportunities at even lower interest rates, further accelerating your financial success.

Seeking Professional Credit Counseling

If your debt feels unmanageable and you are struggling to make even minimum payments, seeking help from a non-profit credit counseling agency can be a wise move. These organizations can help you set up a Debt Management Plan (DMP), where they negotiate with creditors on your behalf to lower interest rates and consolidate payments. Unlike for-profit debt settlement companies, reputable non-profit counselors focus on education and sustainable repayment without severely damaging your credit long-term.

The Psychological Shift: Debt as a Choice

Long-term success in debt management requires a shift in mindset. You must view debt not as an inevitability, but as a choice. By adopting a debt-averse lifestyle, you prioritize financial freedom over immediate gratification. This shift involves questioning every purchase and considering the long-term impact of borrowing. When you view money as a tool for building a future rather than a means for current consumption, your relationship with debt changes fundamentally.

Transitioning from Debt Repayment to Wealth Building

The ultimate goal of smart debt management is to reach a point where your money starts working for you rather than for your creditors. Once high-interest debt is eliminated, the funds previously used for payments should be redirected into retirement accounts, stocks, or real estate. The discipline learned during the debt repayment phase—budgeting, tracking expenses, and delayed gratification—is exactly what is needed to build significant wealth. Success is not just being debt-free; it is being financially independent and secure.